salt tax repeal new york

New York led a group. New York Democrats are turning up the heat on their party to repeal the cap on state and local tax deductions.

Pelosi Supports Restoring Tax Break That Benefited Californians

According to WalletHub when you measure taxes on individual.

. Remember the deadline to elect into New Yorks entity-level tax workaround is October 15 2021. High-tax states lost 10000 break under Trump administration. Kathy Hochul and Attorney General Letitia James was also supported by Connecticut.

Mary would also claim a 22950 credit for taxes paid to another state on her. Nita Lowey D and Pete King R have reintroduced their bipartisan bill to restore the full state and local tax SALT deduction as the cap. Tom Suozzi has taken a leading role in fighting to restore a tax deduction that.

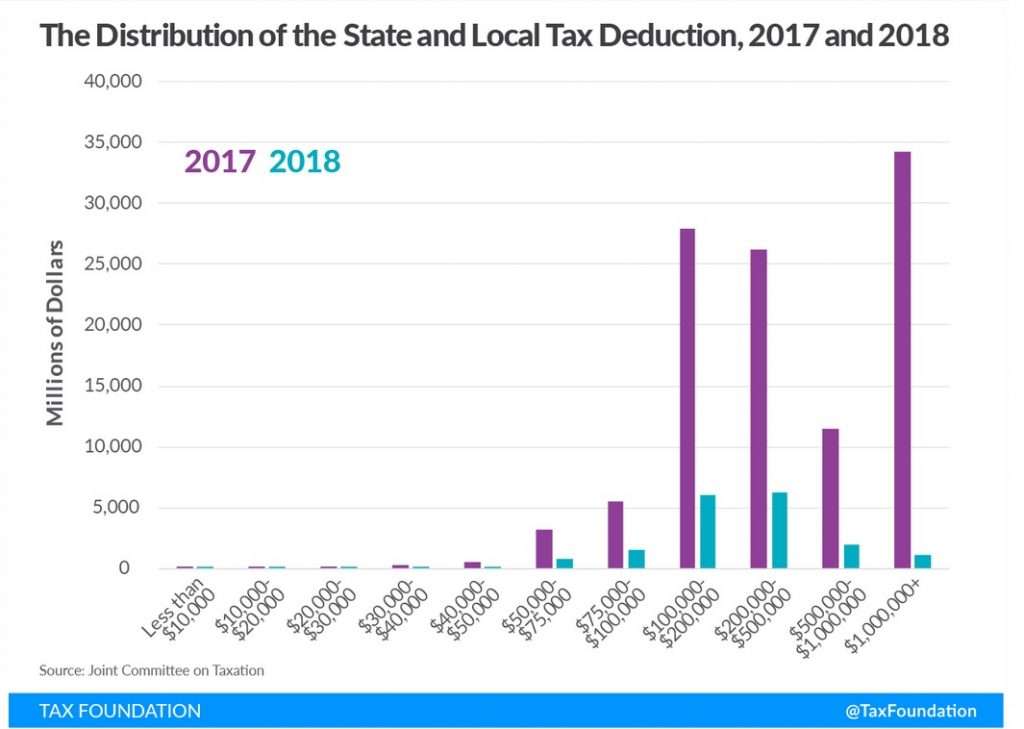

By Naomi Jagoda - 010419 1223 PM ET. The federal Tax Cuts and Jobs Act of 2017 eliminated full deductibility of state and local taxes SALT effectively costing New Yorkers 153 billion. New Yorks economic competitiveness would improve after the repeal of the federal State and Local Tax deduction cap state budget experts said Thursday after Gov.

Republicans had slashed the SALT deduction to 10000 in their 2017 tax cut bill a move that some Democrats derided as a partisan revenge mission against high-tax blue states like New York New. April 11 2021 700 pm ET. Since Mary has already reached the 10000 SALT deduction limits she wouldnt get a tax deduction for the tax paid to Wisconsin.

Suozzi says SALT tax relief has to be part of budget deal. By Nick Reisman New York State. With a top tax rate of 765 ignoring the graduated rate schedule Mary would pay 22950 300000 x 765 in tax to Wisconsin.

New York seeks Supreme Court review of SALT cap. Recently a temporary two-year repeal of the SALT cap was proposed which if successful would cost approximately 95 billion per year. New York estimates its taxpayers will end up paying 121 billion in extra federal taxes from 2018 to 2025 because of the SALT cap.

A new bill seeks to repeal the 10000 cap on state and local tax deductions. Blue states like New York and California want to restore the unlimited state and local tax or SALT deduction. The Long Island congressman says the limits on deductions for state and local taxes must be repealed.

PUBLISHED 549 PM ET Apr. New York governor says states taxes to be lower after repeal. The Supreme Court declined to review a New York-led constitutional challenge to the 10000 cap on state and local tax deductions imposed by Congress in the 2017 tax law.

Passed through Congress under former President Donald Trump New York New Jersey Connecticut and Maryland led the charge to overturn the 10000 cap on state and local tax deductions SALT. Andrew Cuomos spin on the tax hikes in the state budget approved this month is this. The push backed by Gov.

New York state on Monday made another attempt to overturn the 10000 cap on state and local tax deductions amid broader efforts in Congress to raise the ceiling and undo part of a 2017 tax law. Supreme Court has rejected a challenge from New York and three other states to overturn the 10000 limit on the federal deduction for state and local taxes which is known as SALT. Democrats from high-tax states like New York New Jersey and California have spent years promising to repeal the cap and are poised to lift it to 80000 through 2030 before reducing it back to.

Most of the states House delegation threatened to oppose future tax legislation. The 10000 SALT limit enacted by former President Donald Trumps signature tax overhaul has been a pain point for high-tax states such as New York New Jersey and California because residents. Americans who rely on the state and local tax SALT deduction at tax time may be in luck.

Cuomo Sees Blow From New York Tax-Hike Plan Offset by SALT Repeal. Bidens DOJ is trying to preserve the 10000 limiteven though Trump enacted it. As members of the New York Congressional Delegation we urge you to insist on full repeal of the limitation on the State and Local Tax SALT deduction passed by Congress in 2017 and signed into.

New York is taking another run at repealing SALT cap. Whats worse is that the law disproportionately hurts Democratic states like New York which already contributes 356 billion more annually to the federal government than it gets back. That law the Tax Cuts and Jobs Act of 2017 did cut taxes for some but increased taxes on many not rich homeowners in certain states notably New York where it costs people an extra 12 billion.

They wont really count when the 10000 cap on state and local tax deductions is repealed by Congress.

Naor Deleanu 42applesenergy Twitter

Salt Deduction Disliked On Both Sides May Live Another Day As Congress Debates 1 75 Trillion Social Spending Bill Marketwatch

Suffolk Exec Seeks End Run Around Salt Deduction Cap

Rockville Centre L I Taxpayers Endure Salt Deduction Cap Herald Community Newspapers Www Liherald Com

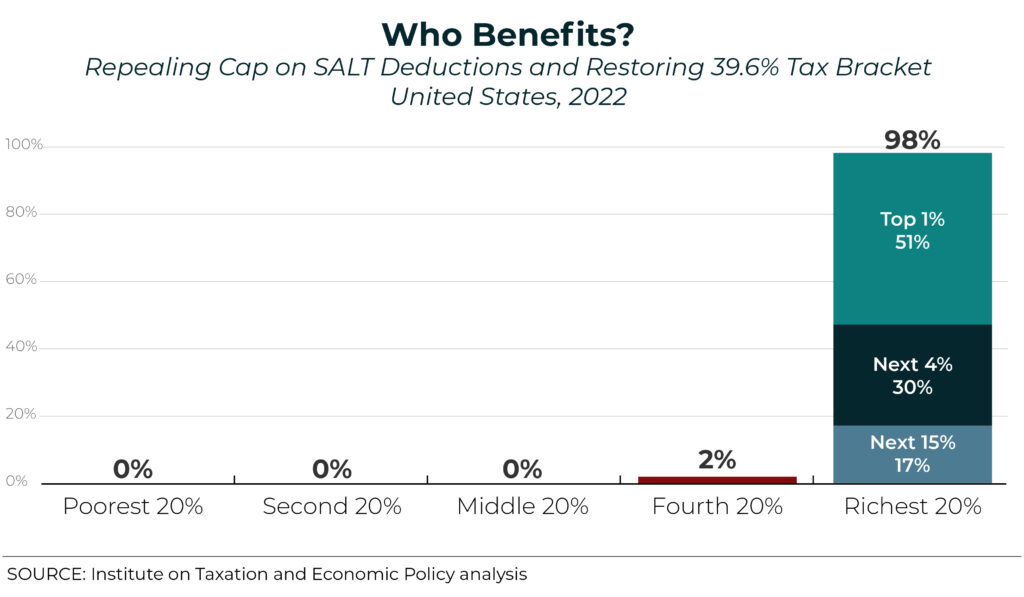

Democrats Salt Tax Fix Could Come With New Minimum Tax On Upper Income Households The Washington Post

What Is Salt Tax Deduction Mansion Global

Eat The Rich House Democrats Plan To Pass Huge Tax Break For Wealthy Homeowners

House Democrats Propose Increasing Salt Cap To 72 500 Through 2031

Senate Gop To Delay Corporate Tax Cut Repeal Salt Deduction Roll Call

Trump Salt Tax Dispute Threatens To Delay Biden Infrastructure Plan

Could The State And Local Property Tax Salt Deduction Limit Be Repealed In 2022 Under The New Stimulus Bill Aving To Invest

House Democrats Propose Increasing Salt Cap To 72 500 Through 2031

Salt Deduction Disliked On Both Sides May Live Another Day As Congress Debates 1 75 Trillion Social Spending Bill Marketwatch

Urban Transporation Congestion Trends Sanjose Congestion Not Good Via Sanjosevoice Siliconvalley Congestion Urban Improve

What Would Be The Impact Of The Salt Tax Cuts On The Legacy Of The Build Back Better Legislation And Democrats Performance In The 2022 Midterms R Politicaldiscussion

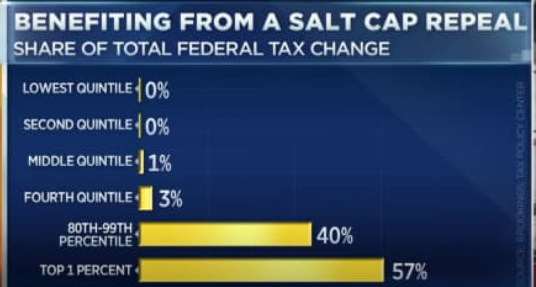

House Democrats Latest Bill On Salt Deductions Would Mean Bigger Tax Cuts For The Rich Itep